Saudi Arabia is one of two countries in the world capable of flooding the global oil market with oil or starving it. The other is Russia. By 2020 they could be joined by Iraq.

Russia is the world’s top oil producer and exporter. It is also the world’s second largest producer of natural gas after the U.S., but is the number one exporter.

In 2014 and before the global collapse of crude oil prices, 50 percent of Russia’s budget and about 68 percent of its export revenues came from oil and gas exports. Now, with the current price of crude oil and the fact that the natural gas price is derived from that of crude oil, Russia’s economy is, at least in the short term, being hurt and must be under enormous pressure. Ironically, Russia has so far shown no effort to reverse the decreasing trend of oil prices and displays no willingness to cooperate for that purpose.

In 2015, Russia’s total oil production was estimated at 11 million barrels a day (mbd). Given that Russia’s domestic oil consumption is just 3.11 mbd, some 7.89 mbd of crude and refined products were exported. Saudi Arabia, on the other hand, is currently producing some 10.19 mbd of oil and consuming 3.32 mbd with exports amounting to 6.87 mbd.

In the quartet meeting of Russia, Saudi Arabia, Qatar and Venezuela, held in February in Doha to agree to a freeze on current oil production, Russia stood beside Saudi Arabia in only accepting to stabilize their crude oil outputs at the levels they were at the end of January 2016. This hardly made any difference to the glut in the market estimated between 1.5-2.0 mbd, since most estimates showed that Russia and Saudi Arabia have basically no capacity to further raise their oil production anyway.

In light of above facts, it is likely that Russia and Saudi Arabia have come to an understanding about what the Saudis call protecting their “market share”.

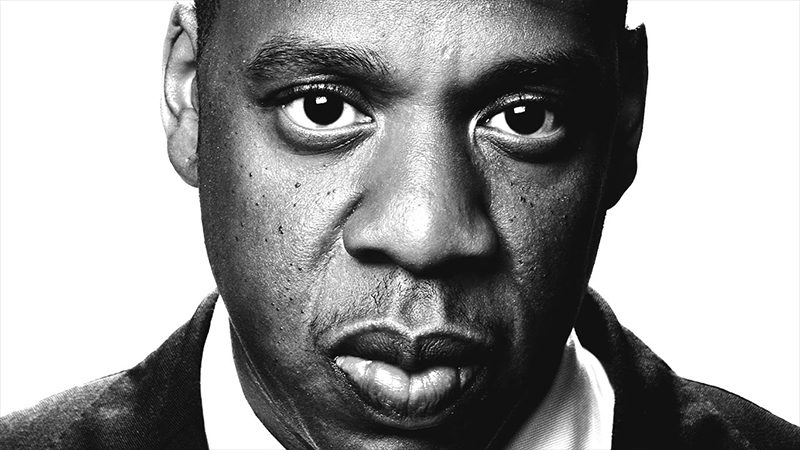

Russian sources have confirmed the Saudis have been pressing them for an “oil alliance” whereby Russia and Saudi Arabia, the world’s two biggest oil producers, would coordinate their production so as to dominate the oil market together. The idea is that the Russians would work with the Saudis to support the oil price by agreeing with them on future output levels whilst dividing the market with them (see Photo).

Given that this is so, and given that Saudi Arabia’s interest is to preserve market share, it is easy to see why the Saudis should approach the Russians to offer an oil alliance. In order to seal the alliance and make it more effective the Saudis are reported to have offered the Russians membership of OPEC (Russia at present is only an observer). The Russians are yet to respond to the Saudi proposal. They are busy expanding aggressively into the Chinese energy market where they have ousted the Saudis as the biggest oil supplier to China.

Courted as Oil Allies: Russian President Putin & Saudi Deputy Crown Prince Mohammad bin Salman

If such an understanding does in fact exist, it raises the question as to how long it can actually last. The prevailing glut in the market will not last forever. Just as fast as prices of crude oil have fallen over the past two years or so, they could easily spring back again. One reason is that these recent price drops reflect supply patterns that are driven almost entirely by geopolitics and geopolitics can quickly shift.

How long can Russia and Saudi Arabia actually put up with the market share challenge? More importantly, how long can the two rivals withstand the losses caused by the low price of oil and the resulting economic pressures? Perhaps this is the clue to Russia’s stand on production cut. Who will yield to the pressures first? Russia or Saudi Arabia?

The actual dependence of the Saudi economy on oil is more than that of Russia on oil and gas. Some 90% of Saudi’s export revenues come from oil exports. Prior to the downfall of the Soviet Union and the ensuing Mafia-style looting of State assets that climaxed under former Russian president Yeltsin’s era, some huge industries were active in that country.

There is just no comparison between Russia and Saudi Arabia in technical, industrial and scientific bases needed for economic development and freeing the country from dependency on a single commodity. Russia has some of the world’s most sophisticated and advanced technical, industrial and scientific bases. Unfortunately the Russians, under seventy years of communist regime, have failed to convert their technical prowess into exports of manufactured goods with the exception of weaponry. It must be noted, however, that the high prices of oil and revenues generated by export of oil and gas in the post-Soviet era were in fact poisonous for the Russian economy because they simply intensified its dependence on oil and gas and plagued it with the resource curse. In that sense, and if Russia intends to be saved from such a predicament, a low oil price could be an opportunity (a blessing in disguise) for that country. Perhaps that is why Vladimir Putin has recently issued some executive orders to rid Russia’s economy of dependence on oil and gas export revenues.

So to the question as to who will yield first to the oil price pressure, the answer is definitely Saudi Arabia. It blinked first when it accepted in principle during the meeting of OPEC oil ministers in Algiers the necessity for an oil production cut by OPEC to strengthen the oil price and an exemption of Iran and Libya from oil production reduction. Russia has so far played its cards close to its chest.

On the other side, Saudi Arabia has stepped into an era of serious challenges. Following the demise of King Abdullah, the balance of power in the kingdom has undergone radical changes and the internal power struggle in the House of Saud has intensified. At the regional level too, the Saudis have been dragged into a costly, far-reaching and seemingly unending war in Yemen. Besides, the U.S. has visibly turned away from its former allay.

Maybe the Russians, too, have felt that Saudi Arabia is off track? If a coup de grace knocks out the Saudi government before it hits the Russian economy, then the problem is already fixed for Russia. As a result, the exit of the Saudi oil, or at least a significant portion of it, from the global market will not only push its price up, but will create such a shortage in the global energy market that even the rise in the production of shale oil will not be able to compensate for, and will provide a huge opportunity for the Russians.